estate trust tax return due date

Therefore Zach does not need to lodge a trust tax return for the estate. Estate transfer tax is imposed when assets are transferred from the estate to heirs and beneficiaries.

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service

Income year 2 is 1 July 2022 to 30 June 2023.

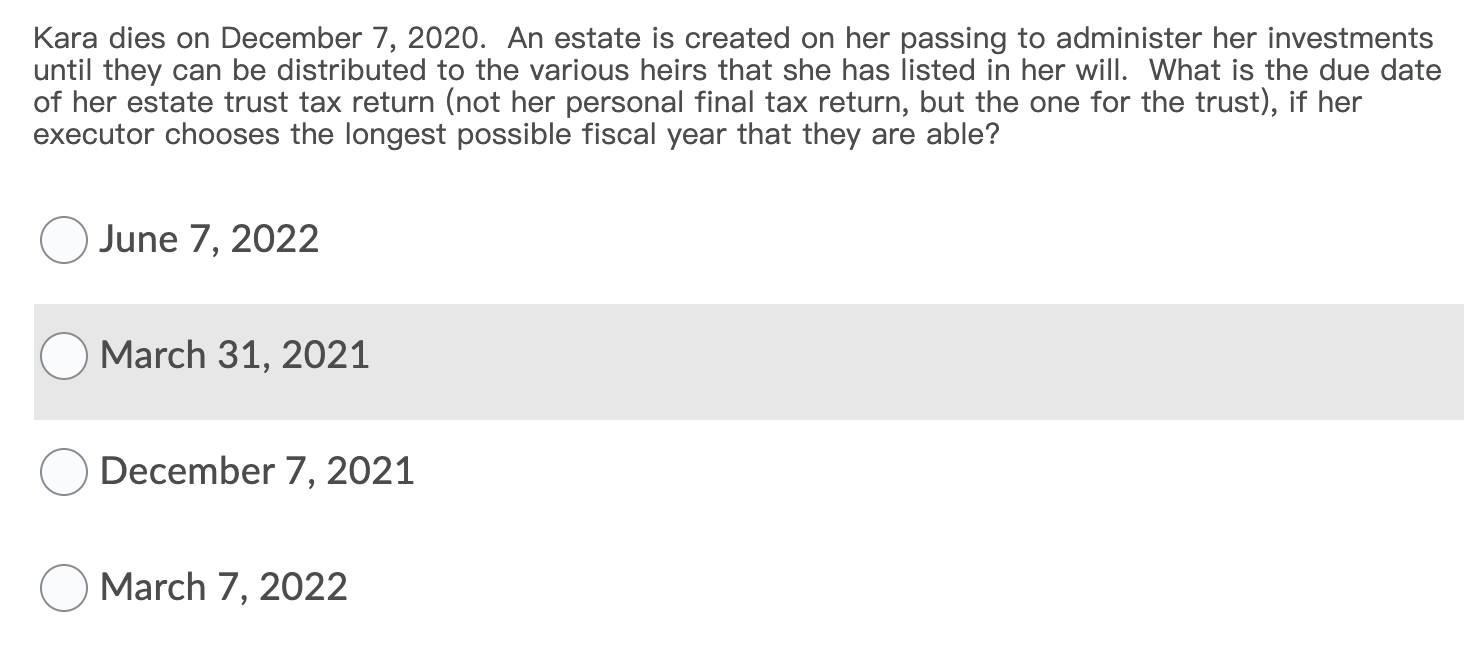

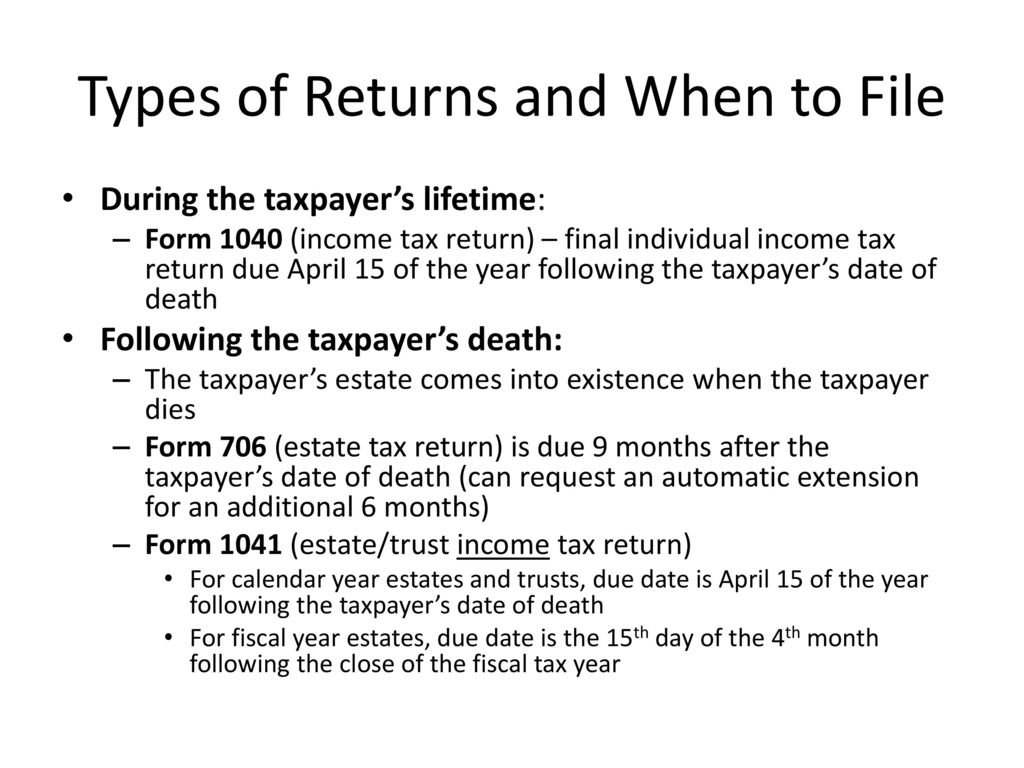

. I need to amend a. For trusts on a fiscal year the trust tax return filing deadline is the 15th day of the fourth month. Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1 -- 29-JAN-2021.

What is the due date for IRS Form 1041. 31 for instance that gives you until April 15. Form 1041 is due by the fifteenth day of the fourth month after the close of the trusts or estates tax year and can be sent either electronically or by post.

If your federal change decreases the tax due to. Form 1041 was added to the Modernized e-File MeF platform on. For a T3 return your filing due date depends on the trusts tax year-end.

For trusts operating on a calendar year the trust tax return due date is April 15. In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4 summaries no later. The form to file is 1041 the income-tax return for trusts and estates.

Due dates and mailing addresses Estates. For calendar-year file on or before April 15 Form 1041 US. Trust and Estate Trade.

The tax return and payment are due nine months after the estate owners date of. Income Tax Return for Estates and Trusts and Schedule K-1 Beneficiarys Share of. Trust and Estate Partnership.

The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District. 31 rows Generally the estate tax return is due nine months after the date of death. Due Date for Estates and Trusts Tax Returns.

Income tax liability of the estate or trust. Report income distributions to beneficiaries and to the IRS on. Due on the 15th day of the 4th month after the tax year ends.

Trust and Estate UK. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. Estimated Payments for Taxes.

The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six. Correction to the 2020 Instructions for Schedule K-1 Form 1041 -- 15-JUL-2021. Calendar year estates and trusts must file Form 1041 by April 18 2022.

When filing an estate return the executor follows the. The return is required to be filed on or before April 15 if on a calendar year basis and on or before the 15th day of the fourth month following the. However a trust or an estate may also have an income distribution deduction for distributions to beneficiaries.

Income from membership of Lloyds. Due date of return. In this income year.

If you pick Dec. One year after the date your Illinois tax was paid whichever is latest. The first payment for a calendar year filer must be filed on or.

Employment tax on wages paid to household employees. Whatever date you set for the end of the. California Fiduciary Income Tax Return booklet FTB 541 BK Visit Forms to get older forms.

Three years after the date your original return was filed or. Recently filed 2021 1041 Trust tax return for deceased parents trust - inadvertently entered the wrong date for Box - Answered by a verified Tax Professional. The estates income is 30000 which is above the.

For example for a trust or estate with a.

Estate Tax Return Do I Need To File One Credit Karma

Itr Filing Income Tax Return Types Of Forms And Penalty For Missing Deadline

Income Tax Accounting For Trusts And Estates

Deceased Estate Trust Tax Return Trt Form Lodgeit

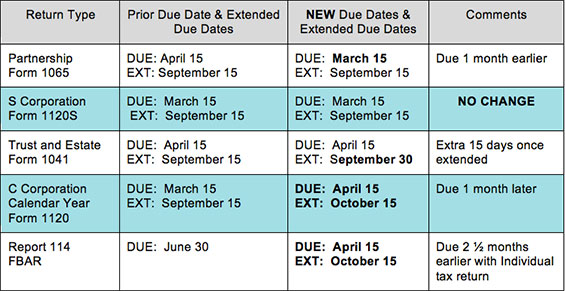

News Alert Tax Return Due Dates Changes For 2016 Tax Year S J Gorowitz Accounting Tax Services

Extend 1041 Tax Return Deadlines For Your Trusts Estates With Form 7004

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

When Are Trust Tax Returns Due

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Irs Postpones Due Date For Filing Of Gift Tax And Estate And Trust Income Tax Returns And For Payment Of Tax

Introduction To Income Tax Of Trusts Estates Youtube

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

Federal Income Tax Deadlines In 2022

2015 Oklahoma Resident Fiduciary Income Tax Forms And Instructions Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

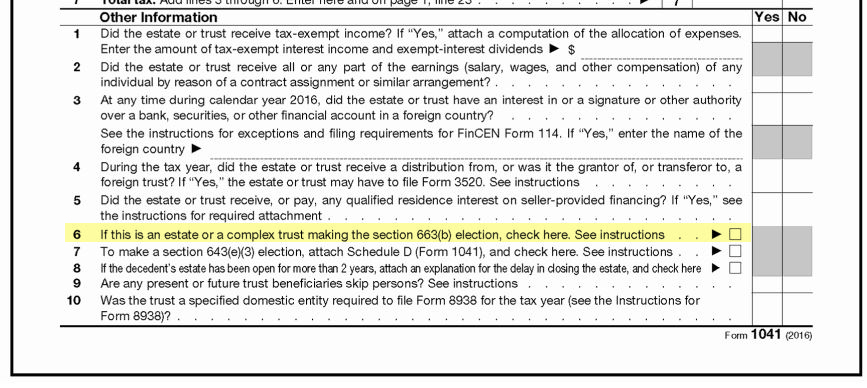

What Every Fiduciary Should Know About The 65 Day Rule Marcum Llp Accountants And Advisors

Estate Tax Return Tax Services By Bajwa Cpa In Mississauga

Irs Barnes Walker Law Firm Sarasota Bradenton Palmetto Manatee County Fl

2012 Virginia Estimated Income Tax Payment Vouchers For

Tax Deadline Extension What Is And Isn T Extended Smartasset

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video Online Download